Transaction volume in the Bitcoin Lightning Network (LN), an off-chain payment protocol aimed at solving Bitcoin scalability issues, is up. Specifically, the amount of Bitcoin (BTC) stored in Lightning Network channels has increased by almost 300%. Here’s what you need to know.

Bitcoin Lightning Network, Explained

The Bitcoin Lightning network is a network of payment channels built on top of the Bitcoin blockchain. Thaddeus Dryja and Joseph Poon published the original protocol whitepaper in 2016.

It went live in early 2018 but faced a Distributed Denial of Service (DDoS) attack in March 2018. In the attack, 200 nodes went down.

The main problem with Bitcoin adoption as a currency is the speed and cost of payments, otherwise known as the ‘Bitcoin scalability issue’. This protocol addresses this issue by creating a network of payment channels that facilitate micropayments—without anyone actually holding the funds.

How It Works

Specifically, the Bitcoin Lightning Network addresses scalability by taking away the need for secure cryptocurrency exchanges.

Instead, it uses a process called atomic swaps. This is when two parties hold cryptocurrency in different channels. If the sender wants to give a certain amount of cryptocurrency to the receiver, then both chains have to record that transaction. If they don’t match, the sender has the option of backing out of the transaction.

Bitcoin Lightning Network Volume Up 300%

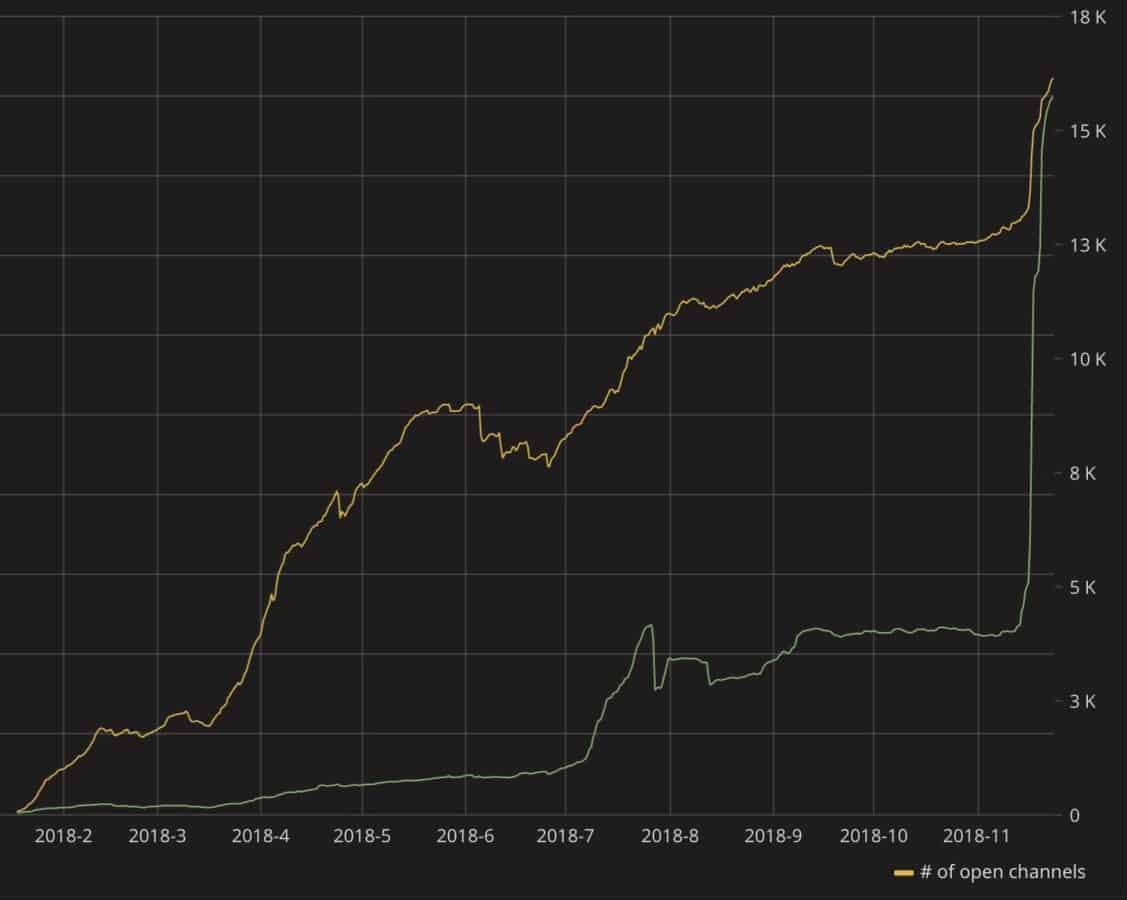

Bitcoin Lightning Network (LN) channel data. Grafana.

Between November 12 and 22, Bitcoin Lightning Network volume increased 300%. Specifically, the total channel value on this network skyrocketed from 114.69 to 448.6 BTC, which is a 291% increase.

Additionally, the number of open channels went from 13,000 to 16,300, according to Grafana. This is a 25% increase.

One reason for this sharp increase in volume is the Bitcoin Cash (BCH) fork. Though BCH increased in popularity, its decrease in value has potentially inspired some cryptocurrency investors to return to Bitcoin.

The Bitcoin Lighting Network for Other Cryptocurrencies?

Stellar (XLM) has advocated for LN adoption and suggested that it is the way of the future. And Bitcoin could only be the first cryptocurrency to adopt similar, off blockchain transactions for speed.