Over the past 7 days, TrueUSD (TUSD), USD Coin (USDC), Aurora (AOA), Paxos Standard Token (PAX) and QuarkChain (QKC) experienced the most significant cryptocurrency price increases. Despite a recent downturn for Bitcoin (BTC) and Bitcoin Cash (BCH), here’s why these crypto outliers are in the black.

QuarkChain (QKC)

QuarkChain (QKC) 7-day price chart. CoinMarketCap

Market Cap: $38,800,000*

Price: $0.048

7-Day Increase: 48.7%

QuarkChain (QKC) led this week’s crypto price increases at 48.7%, according to CryptoTrackerBot data. And at $38,800,000, QuarkChain (QKC) has the lowest market cap of this week’s price leaders.

This coin exists on the QuarkChain (QKC) blockchain, which is a two-layered protocol designed to facilitate 100,000+ TPS or transactions per second. The first blockchain is sharded. Sharding is when each shard, meaning a part of a database, is stored on a separate server. It makes blockchain-based transactions more efficient. Cross-shard transactions take minutes.

QuarkChain prioritizes security. In this network, 50% of the hash power goes towards preventing double spending.

*Market Cap figures are rounded to the nearest hundred thousand. Price data is rounded to the nearest hundredth.

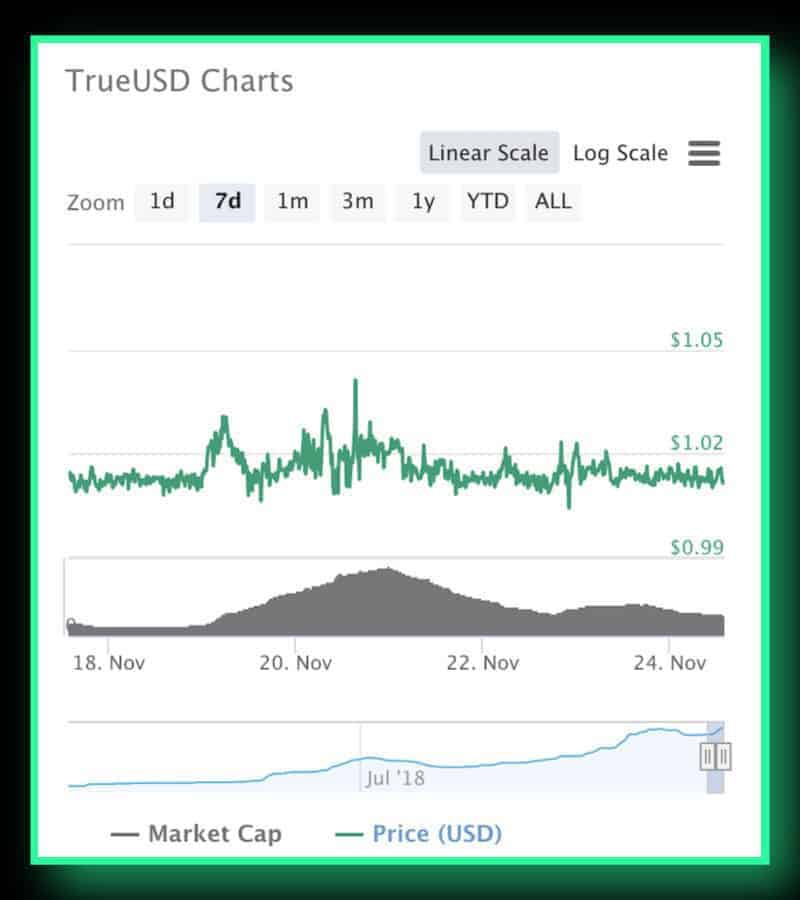

TrueUSD (TUSD)

TrueUSD (TUSD) 7-day price chart. CoinMarketCap

Market Cap: $185,900,000

Price: $1.01

7-Day Increase: 29.7%

TrueUSD (TUSD) is a stablecoin, meaning that it’s a token backed by the same amount in US Dollar. In theory, this means that you can redeem each TUSD token for $1 USD at any point.

Worth $1.01 USD, TrueUSD (TUSD) has technically broken its peg. One reason for TrueUSD’s price increase this week could be renewed market interest in stablecoins in general. Earlier this week, Tether (USDT) daily trading volume was up 30%, as bear market investors moved funds from more volatile cryptocurrencies into the stablecoin.

Paxos Standard Token (PAX)

Paxos Standard Token (PAX) 7-day price chart. CoinMarketCap

Market Cap: $140,200,000

Price: $0.99

7-Day Increase: 29.0%

Paxos Trust Company created PAX, a stablecoin, backed 1:1 by the US Dollar, with fast transaction times. The company behind it is a New York State-regulated Trust for digital assets.

There are no USD/PAX or PAX/USD conversion fees, no transaction fees and a low barrier to entry: Investors must convert a minimum of $100 USD/PAX.

Paxos Standard Token (PAX) was also one of last week’s cryptocurrencies with the biggest price moves.

USD Coin (USDC)

USD Coin (USDC) 7-day price chart. CoinMarketCap

Market Cap: $170,900,000

Price: $1.01

7-Day Increase: 27%

The third stablecoin on this week’s list of cryptocurrencies with the biggest price increases, USD Coin (USDC) is a USD-backed cryptocurrency. Circle, the company that created the coin, is an open-source project that includes developers from Coinbase.

USDC aims to combine the speed of cryptocurrency with the security of accredited financial institutions. Most major cryptocurrency exchanges, including Binance, Poloniex, Coinbase and KuCoin trade USDC.

Aurora (AOA)

Aurora (AOA) 7-day price chart. CoinMarketCap

Market Cap: $141,100,000

Price: $0.02

7-Day Increase: 22.0%

Aurora is an Ethereum-based financial network focused on smart contracts and DApps. Aurora (AOA) is a type of stablecoin that exists on this network and facilitates exchanges within it. But unlike other stablecoins entirely backed by the USD, a combination of cryptocurrency, debt and retailers back AOA.

Aurora (AOA)’s consensus mechanism is delegated proof of stake (DPoS) as a consensus mechanism, meaning that transactions within this network are fast and cheap, and potentially an alternative to Ethereum.

Stablecoins Dominate This Week’s Crypto Price Moves

Bear investing has dominated the cryptocurrency market in recent times, and has reached an all-time high following the Bitcoin Cash (BCH) hard fork.

With the price of Bitcoin on the decline, stablecoins like TrueUSD (TUSD), Aurora (AOA), USD Coin (USDC) and Paxos Standard Token (PAX) continue to appeal to reticent investors. However, this week’s top gainer, QuarkChain (QKC), facilitates fast and secure payments via a two-tiered application of blockchain technology.