If you have any interest in investing or trading, you need to know what an ETF is. Exchange traded funds are an increasingly important part of the investment landscape—and that includes cryptocurrency. Below you’ll find all the information you need to make sense of the world of exchange traded funds. In particular, you’ll better understand how ETFs function in the context of cryptocurrency.

What is an ETF? The Basics

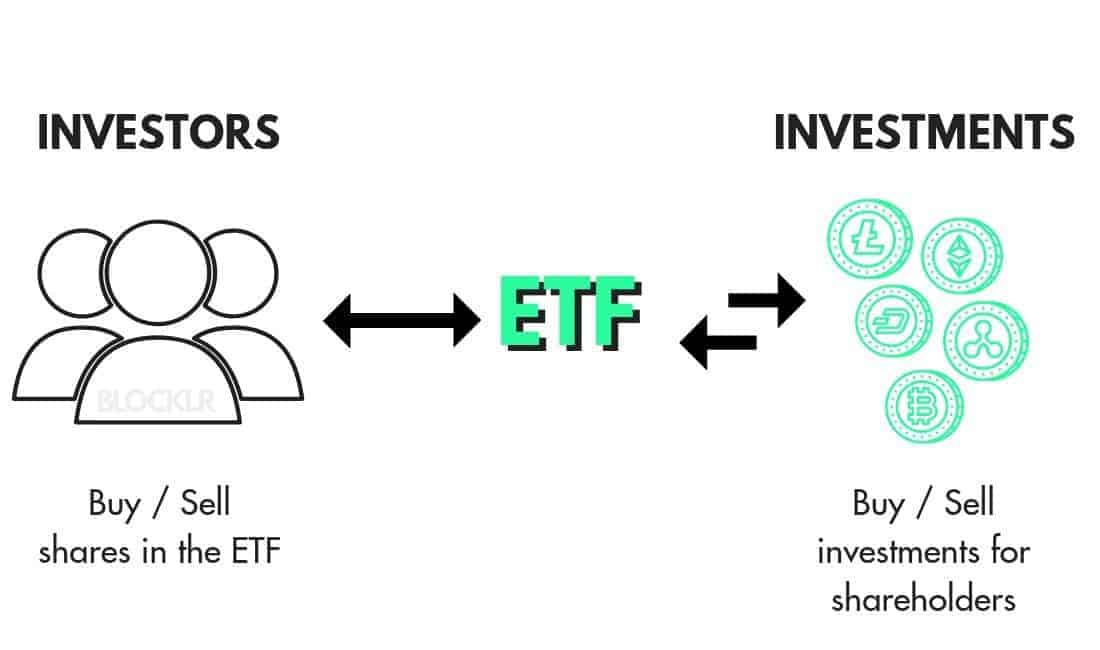

An exchange traded fund is an investment vehicle that functions in distinction to mutual funds and index funds. In particular, an ETF is a basket of securities that are bought and sold the same as regular shares of stock.

ETFs first started picking up momentum around 1993. Since then, they have exploded in popularity. Today, ETFs are one of the most popular ways to invest. That’s primarily because they allow investors to buy into diverse portfolios but without having to deal with potentially costly and slightly more clunky mutual funds.

Somewhat similar to an index fund, an ETF is built to track a particular asset class. As such, there are ETFs for pretty much anything you can imagine. That includes everything from energy to pharmaceuticals, tech, marijuana, and seemingly everything in between.

At its foundation, an ETF consists of a bundle of assets owned by the fund. Investors then buy into a portion of the fund. Importantly, they do not actually own the underlying assets. Rather, they buy an interest in the overall fund.

ETFs trade during the day just like regular stocks. That means they have their own ticker symbol, their value changes throughout the day, those changes can be tracked, and when you buy or sell an ETF you typically only pay the standard transaction fees attached to regular stock trading.

Benefits of ETFs

There are a number of clear advantages to buying and trading ETFs. As outlined by investment experts at Fidelity, these benefits include:

- The ability to buy and sell at any point during the regular market day. In contrast, mutual funds settle only after the close of the market.

- When you buy and sell ETFs there are much lower fees than something like a mutual fund. Because an ETF trades like a regular share of stock, you should only have to pay standard brokerage fees.

- Additionally, ETFs are structured such that investors have more control over when they pay capital gains taxes.

- Unlike mutual funds, you can set a variety of orders including limit orders, stop-loss orders, and other similar transactions. This is the result of an ETF being set up like a regular share of stock.

- Investors are entitled to a proportionate share of any dividends, interests, or gains accruing from the fund’s underlying assets.

Disadvantages of ETFs

While there are a number of clear advantages associated with an ETF, there are also some disadvantages. These include:

- In general, ETFs are affordable. But if you’re investing smaller amounts on a more frequent basis, you may be better suited with other, lower cost investments.

- Depending on the ETF you’re purchasing, you may run into wide bid/ask spreads. When this happens, you could end up buying into the fund at higher prices and selling at lower prices.

- In general, ETFs track their given index relatively well. But they’re not perfect. Sometimes, technical errors get in the way. When this happens, you’re probably better off with an index fund.

- ETF sales don’t settle for two days after you sell. Keep this in mind, since it means that the funds you receive from a sale won’t be available to you for 48 hours.

Cryptocurrency ETFs

Now that you have a general sense of what ETFs are, let’s look at ETFs in the world of cryptocurrency. In many ways, ETFs could be an excellent structure for investing in crypto.

In theory, a crypto ETF would function in one of two ways. First, it could hold a bunch of tokens in one particular currency. Investors would then own a share of the underlying basket of crypto. As a result, investors would be entitled to a share of all gains made.

Alternatively, a crypto ETF would own tokens in several different cryptocurrencies. This would make it possible for a large number of investors to own stake in a range of currencies but without having to actually purchase each and every one.

Further, this type of a crypto ETF would allow investors to own a diverse portfolio of currencies without having to manage multiple wallets or keep close tabs on each individual currency. Instead, they would only have to monitor the fund as a whole.

Likewise, this type of crypto ETF would essentially spread out risk and allow investors to tap into gains in one currency while potentially lessening losses in other currencies.

Crypto Exchange Traded Funds Now and in the Future

However, at the moment, crypto ETFs do not really exist—at least not in the U.S. There are simply too many regulatory barriers. According to experts, the SEC has so far said that cryptocurrency is too volatile and unproven to gain approval for an ETF.

But, the agency also says that if crypto can demonstrate long-term viability, it could eventually allow for the creation of crypto ETFs.

In fact, 2018 has been a big year for crypto ETFs. Earlier this year, 10 Bitcoin ETFs were proposed to the SEC. The prospects of finally seeing crypto ETFs was exciting to many. But the SEC rejected the first nine proposals.

Word is still out on the tenth proposal. In fact, the SEC has until September 30 to make up its mind. Until the agency issues its final decision, there is always the possibility that we could see the first crypto ETF.

Regardless what happens at the SEC, crypto investors can always look abroad for crypto ETFs. Of course, this will probably require a bit more legwork on the research side. Additionally, it could require investors to jump through more regulatory and transactional hoops.

One way or another, the prospects of easily accessible crypto ETFs seems promising. The key is crypto’s ability to demonstrate security against frauds and scams, as well as its viability as a sustainable form of currency. If all the pieces come together, it seems likely that investors could someday buy and trade crypto ETFs as easily as any other type of ETF.