Ripple’s Swell 2018 conference was held this past week in San Fransisco. During which, Ripple made many notable announcements. Among which were the findings of Ripple’s first ever “Blockchain in Payments” report. The remarkable results of Ripple’s “Blockchain in Payments” report proves just how beneficial blockchain technology is to the masses and that interest is growing. The results revealed that blockchain adoption is most certainly on the rise.

Ripple’s “Blockchain in Payments” Report

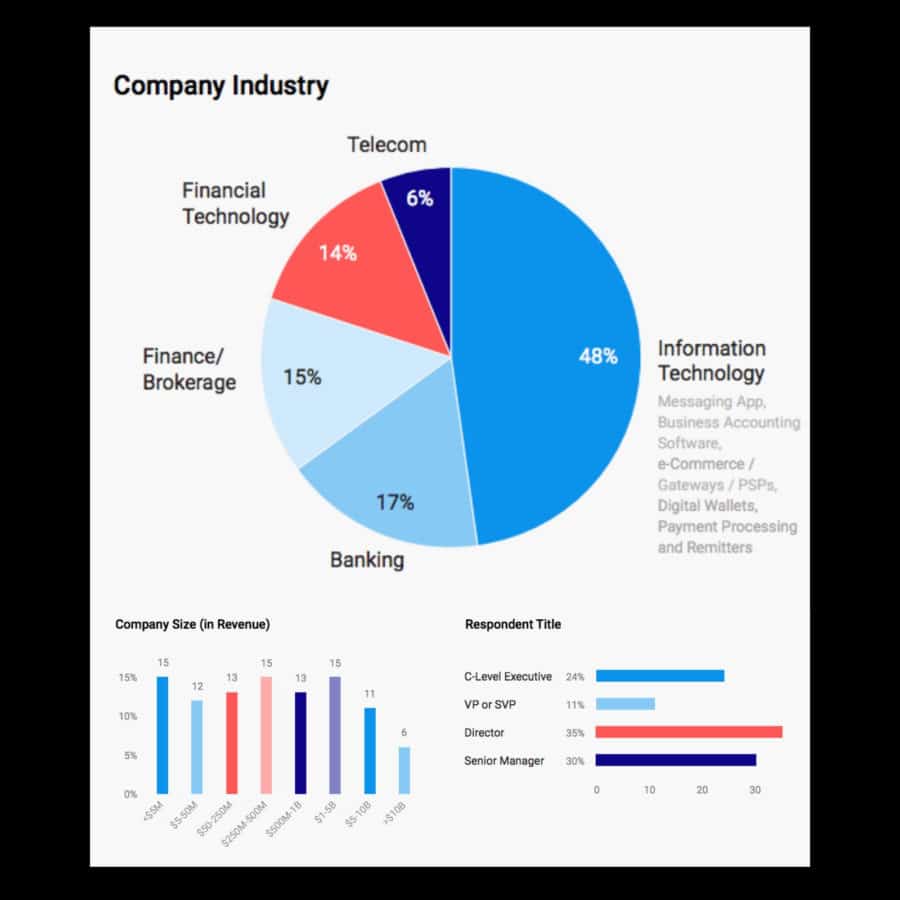

Respondent Demographics From Ripple’s Blockchain in Payments Report 2018

The “Blockchain in Payments” report is the first of it’s kind. Ripple and Celent conducted a study with 676 survey respondents residing in 22 different countries.

The survey addressed some growing concerns within the world of finance and the world in general. For example, it challenged the parallel between the forces of change and the status quo as well as the “Momentum Toward Broad Blockchain Adoption.” Finally, it covered “Digital Assets in the Wake of Blockchain.”

Each respondent surveyed were from various industries including Information Technology, Banking, Finance/Brokerage, Financial Technology, and Telecom.

The respondent’s titles varied from Managers to Executives with company revenues ranging from the millions to billions. These professionals are critical players in the financial sphere, and their moves towards blockchain adoption will most certainly impact the masses on a tangible, personal level.

Ripple Report Shows Blockchain Mass Adoption Approaching

Ripple’s Blockchain in Payments Report 2018

When addressing the adoption (or potential adoption) of brand new technology, it is essential to gauge the willingness for change. Many industries can be reluctant to adopt new technology, particularly those that haven’t experienced much change or technological advancement.

Though, in this case, the report proved that the payment service industry is not only open to change but actively making a difference. 50% of survey respondents said that they are open to solutions that can offer real-time gross settlements, meaning the instant transfer of funds worldwide. On top of this, it appears respondents believe blockchain may be the solution.

All respondents believe:

- 42% blockchain improves speed

- 40% blockchain will connect them to more of the world

- 38% blockchain lowers costs

- 36% blockchain increases transparency

It’s important to note that these answers are not speculative as many of them are already using blockchain technology.

- 18% of respondents are currently in production or approaching production for a blockchain payments use case

- 45% are already in production, piloting, or close to signing with a blockchain provider

- 75% are “extremely” or “very” interested in using a digital asset as a settlement and/or a base currency

Start of a Blockchain Revolution

Graph From Ripple’s Blockchain in Payments Report 2018

The report concludes, stating that “indicators that the tipping point from an interest in blockchain to mass adoption is near. Forces of change are converging.” With vital financial players showing extreme interest in both blockchain technology and cryptocurrency, Ripple predicts that the masses will follow suit. Even Forbes will be implementing journalism on blockchain. Plainly stated, today’s society is fast-paced, and individuals need their transactions and interactions to match. Blockchain offers a fast, safe, and transparent alternative to the masses.

Ripple report shows blockchain mass adoption approaching. Ripple’s “Blockchain in Payments” report offers a significant look into the future of blockchain.