What is Ethereum (ETH)? Ether, or ETH, is the second highest market cap cryptocurrency in the world and has applications and value that differ beyond those of market leader, Bitcoin (BTC). Here’s everything you need to know about this unique blockchain and its cryptocurrency.

What is Ethereum (ETH)?

Ethereum is the world’s second blockchain and cryptocurrency, with the second largest market cap. It was proposed by Vitalik Buterin, a now-famous cryptocurrency developer, in 2013. The protocol went live in 2015. It hard forked in 2016, giving us Ethereum vs Ethereum Classic.

Though an evolution of Bitcoin, Ethereum is a more flexible appliation of blockchain technology—meaning it has applications beyond sending and receiving funds. Here’s a look at why Ethereum is the most popular platform for developpers.

Underlying Technology

First and foremost, Ethereum is an open-source blockchain that uses proof of work to verify transactions. This allows users to send/receive funds that are verified by a network, rather than a centralized entity like a bank or credit card company. Another term for this is peer-to-peer.

What is Bitcoin? While BTC primarily serves as a form of payment, Ethereum is a platform on which developpers can build their own applications.

This is thanks to something called the Ethereum Virtual Machine. A virtual machine is a type of code that functions as a computer. In this case, it means that it can run complex code, like that behind smart contracts and DApps.

Technically, it’s Turing Complete. In other words, this network can theoretically solve any equation, given the appropriate resources.

A Platform for Smart Contracts and DApps

Smart contracts and DApps. Shutterstock

What is Ethereum? It’s a blockchain on with developers can create DApps, or decentralized applications, and run smart contracts, meaning automated agreements.

DApps

A DApp is an application that exists on a decentralized platform, like blockchain. Unlike any app on your iPhone that is managed by a centralized company, DApps exist within a network that verifies transactions without a third party.

Smart Contracts

Similarly, smart contracts exist within a decentralized network. What is a smart contract? A smart contract is a coded agreement with preset terms and qualification, and automated enforcement.

Smart contracts allow parties to agree to a contract without lengthy negotiations, lawyer fees and third parties for enforcement. The moment that one party fulfills their end of the deal, the smart contract will automatically withdraw funds from the second party’s account. These could be held in an intermediary storing location on the blockchain, meaning that no one controls the funds until the service is complete. If not, the second party gets it back.

The term for this is ‘trustless’. You don’t have to trust or even know the person with whom you have a smart contract or DApp because the blockchain automatically holds them (and you) accountable for fulfilling your respective sides of the agreement.

ETH Facilitates the Network

ETH coins. Shutterstock

This means that ETH, also called Ether, powers the network rather than serves as an alternative to cash. Need to add something to a DApp that requires a payment to the network? You pay in ETH.

Unlike Bitcoin, which caps at 21 million Bitcoin, there is no max supply of Ether. Every year, the community can mine a maximum of 18 million ETH, forever. But as the total supply of Ethereum increases, this will come to represent a smaller and smaller percentage of the total supply, until it’s irrelevant.

How the Blockchain Calculates Fees

Now, you can answer what is Ethereum and why you need to use ETH. But how does the virtual machine calculate those fees?

The system relies on a second unit called gas. Gas is the unit the network uses when determining how much computational work a specific action takes. Every action on Ethereum costs a certain amount of gas. And more computer power it takes, the most gas it takes.

Gas Fees

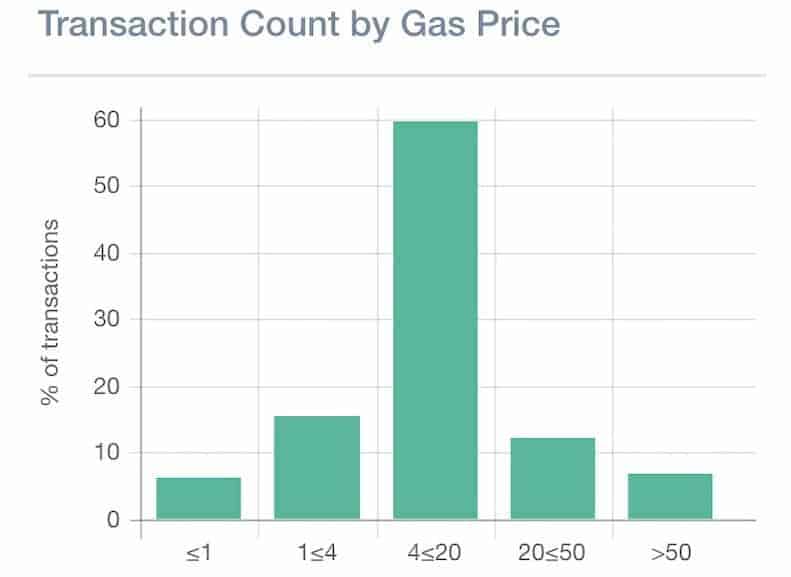

The x-axis shows transaction cost in GWEI. Approximately 60% of transactions cost 20 GWEI at the time of writing. EthGasStation

To get your total gas fees, you have to multiply these two variables together:

- Gas limit: the amount of labor that an action requires

- Gas price: the cost of that labor

Where do these numbers come from?

- Gas limit is how much computational power, in gas, an action takes.

- Gas price is how much you’re willing to pay to have a miner perform that work.

Typically, Gas price is 20 GWEI, which is a very small unit of Ethereum. Specifically, 1 ETH = 1 billion GWEI. However, during high volume transaction times, Gas prices can reach 50 GWEI.

Gas limit is calculated in gas. Specifically, a transaction takes a minimum of 21,000 gas, according to the Ethereum yellowpaper. Keep in mind that the gas/transaction ratio is constantly changing depending on demand.

Why Don’t You Calculate Fees in Ether?

Why doesn’s the network calculate in Ether, rather than gas? In short, the cryptocurrency exists on the cryptocurrency market, meaning that its price shifts constantly. By using gas, the network shields its users from paying exorbitant transaction fees depending on cryptocurrency price.

Ethereum: A Platform for Everything

Ethereum is revolutionary because it’s so flexible. Most new cryptocurrencies are ERC20 tokens: a token that exists on the Ethereum blockchain. It facilitates smart contract and DApp payments.

But the fact that Ethereum represents so many different applications makes it more difficult to understand. You can vote or get compensated for watching advertisements on Ethereum. You can trade solar power or subscribe to a music platform, too.

This tells us a lot about what Ethereum is. At its core, it’s decentralization: the ability to build any app or business, perform any function, without a centralized entity.