A hard fork is one of the most significant events in the cryptocurrency universe. But what is a hard fork? What causes a cryptocurrency fork and what happens after? In this guide, we explain why a blockchain splits and what it means for your cryptocurrency holdings.

What Is a Hard Fork?

Understanding hard forks requires knowing the basics about blockchain technology and what is cryptocurrency as an application of that technology.

Each Blockchain Has a Protocol

In very simple terms, a blockchain is a way of building and moving digital memory and using complex, cryptographic math to make that memory immutable and indisputable.

And because all of this is digital, it involves lots of software. That software establishes a cryptocurrency “protocol.” Protocols set the rules that everyone has to agree upon to use the blockchain and accept the validity of its memory, or ledger.

Here are a few rules a cryptocurrency protocol must establish:

- How big are blocks? In other words, how much memory a block should contain?

- How are miners rewarded for creating a block and how do they receive that reward?

- How much are transaction fees?

Changing the Protocol

Forks have to do with those rules, the protocol that sets the operating parameters of a blockchain. In other words, hard forks change how miners create blocks.

Since these changes are so radical, they alter the fundamental rules of the blockchain, taking the protocol in an entirely new direction. Changes like that create an entirely new blockchain.

Why a Split Happens

Shutterstock

Why do hard forks happen? Essentially, a cryptocurrency forks when its protocol is upgraded. Generally, this falls into two different categories.

1. Disagreements Among Developers

Many times, hard forks are the result of disputes among the people most affected by a cryptocurrency’s protocol.

Software developers and miners working on a project decide something isn’t working for them. One group decides it isn’t satisfied with the current protocol and wants to introduce a change.

When these differences split a cryptocurrency’s community of users, a split is likely the outcome.

2. Major Protocol Upgrades

Not all hard forks are the result of irresolvable disputes among crypto developers and miners. Sometimes, they’re upgrades to the existing protocol to take it in a new direction, usually to specialize its use in some way.

Sometimes, a cryptocurrency splits to restore funds after hackers or other attacks compromise the integrity of the blockchain or make off with millions in cryptocurrency.

A hard fork results in the creation of an entirely new blockchain that is incompatible with the previous blockchain’s protocol. But there are also “soft forks,” or changes, modifications, tweaks that don’t modify the fundamental rules for creating blocks. In a soft split, the new blockchain is still compatible with the old one.

How It Works

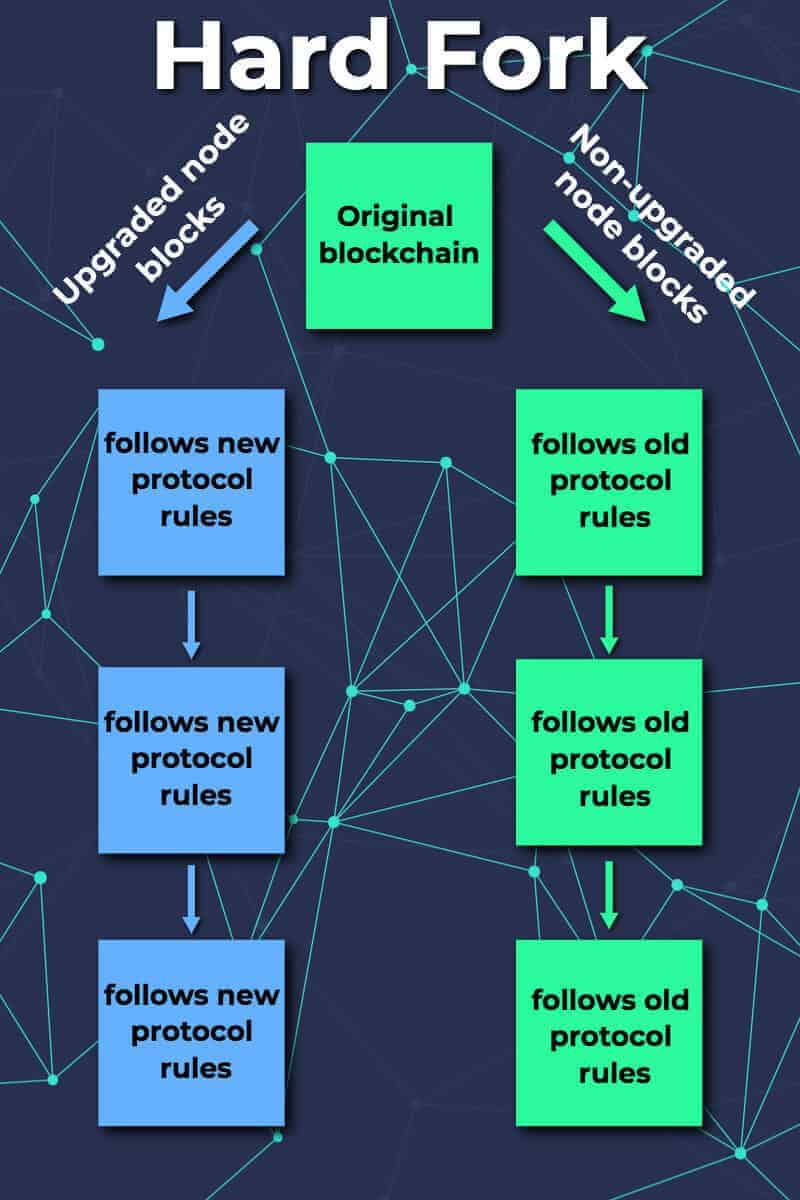

Hard fork diagram. Burgess Powell

Despite the fact that no two cryptocurrency splits are alike, they all come about the same way. Each cryptocurrency involves a protocol and a blockchain.

- The first step in creating a hard fork involves copying the protocol and working on changes to it offline. This is possible because many crypto protocols are open source software.

- After the new rules are defined, the team working on the split picks a block number at which the hard fork will go live and become active. This allows everyone to know exactly when the cryptocurrency split will occur.

- Once the block number is reached, the cryptocurrency fork occurs and the community splits.

- Some continue to support the original protocol and add blocks to the old blockchain.

- Others adopt it and start adding blocks to the new blockchain.

The two blockchains, old and new, are incompatible. But they still share the original blockchain beginning with the block number that initiated it.

How It Affects Holders

When a split occurs, everyone on the blockchain receives as many cryptocurrency units in the new currency as they held in the old.

Lots of people think of this as “new money” or doubling your value. And while it’s true that you double the number of coins you hold, the value of the coins on the new chain will not be identical to the value of the old chain.

And that makes hard forks all about price discovery. How much are people willing to pay to buy or accept to sell the new coin? So how much your new crypto will be worth depends on the value it can attract.

Most Important Hard Forks

There have been many hard forks in cryptocurrency history. This is part of the reason why we have so many cryptocurrencies. How many cryptocurrencies are there? It seems a new one is created or forked every day.

Let’s look at the two most important blockchain splits in cryptocurrency history.

Bitcoin Cash (BCH)

Hard forks happen because there’s dissatisfaction with the currently existing protocol. That’s exactly what caused the Bitcoin Cash (BCH) fork in August 2017.

Users wanted faster transactions, so they proposed increasing block size and making block validation easier and faster. When the first block was created under these new rules, the original Bitcoin blockchain rejected it.

And meant that from then on, Bitcoin Cash would proceed on its own blockchain. Thus, we have Bitcoin vs Bitcoin Cash.

Ethereum Classic (ETC)

Shutterstock

The hard form of Ethereum vs Ethereum Classic came about as the result of a $55 million cryptocurrency hack. After the attack, the Ethereum (ETH) network split into two cryptocurrencies, each on their own blockchain.

Ethereum (ETH) and Ethereum Classic (ETC) have very different protocols, reflecting their divergent ideologies and technical priorities.

Bitcoin Cash (BCH) Hard Fork

The Bitcoin Cash (BCH) blockchain is splitting on November 15, 2018. The Bitcoin Cash hard fork is the result of a rift in the developer community. The new currency, Bitcoin SV (BCHSV) will exist on a seperate blockchain.

In fact, Bitcoin Cash (BCH) is set to split every 6 months with planned protocol upgrades.

How to Prepare

When a cryptocurrency hard forks, there are a couple things that holders of the new currency should keep in mind.

- You need to have access to your private key so that you can claim the new currency. Do not assume that you will automatically receive your cloned currency in your cryptocurrency wallet.

- It is common for currency exchanges to not immediately support the new cryptocurrency fork. In other words, you can’t access your new coins if the exchange doesn’t support it. Storing your coins in a wallet with your private key avoids this problem, and will ensure that you can access your crypto both on the new and old blockchains.

Hard Forks Can Be Beneficial

Hard forks are disruptive events in the cryptocurrency community. But that’s a feature of cryptocurrency technology, not a bug. A cryptocurrency fork can create two different cryptocurrencies that accomplish separate but equally valid goals.

Dispute, debate—these are inextricable from a culture of openness, transparency and decentralization, meaning that a community rather than individuals controls a currency. This was the goal that motivated Satoshi Nakamoto to publish the Bitcoin whitepaper in the first place.