The Gemini Dollar (GUSD), the Winklevoss’ stablecoin, has officially broken its peg to reach an all-time high. Meanwhile, Tether, the world’s most popular stablecoin, has broken its peg in the other direction, falling to its lowest price in 18 months.

Stablecoins are coins pegged to stable assets. Typically, this means gold or fiat. Stablecoins do not have a fixed volume like normal cryptocurrencies. Instead, they are regulated based on market conditions.

The Winklevoss’ Stablecoin: Gemini Dollar (GUSD)

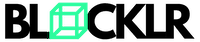

Courtesy of coinmarketcap.com

Gemini Dollar (GUDS) launched in early September. The Winklevoss’ stablecoin exists on the Gemini exchange platform, which they founded in 2014.

Right now, GUSD is experiencing a price surge. GUSD broke its peg to USD when it surpassed $1.14 on Monday, October 15. And on October 16, it’s price hit an all-time high of $1.19.

It was recently listed on BlockFi, and other exchanges.

GUSD Surpasses Tether

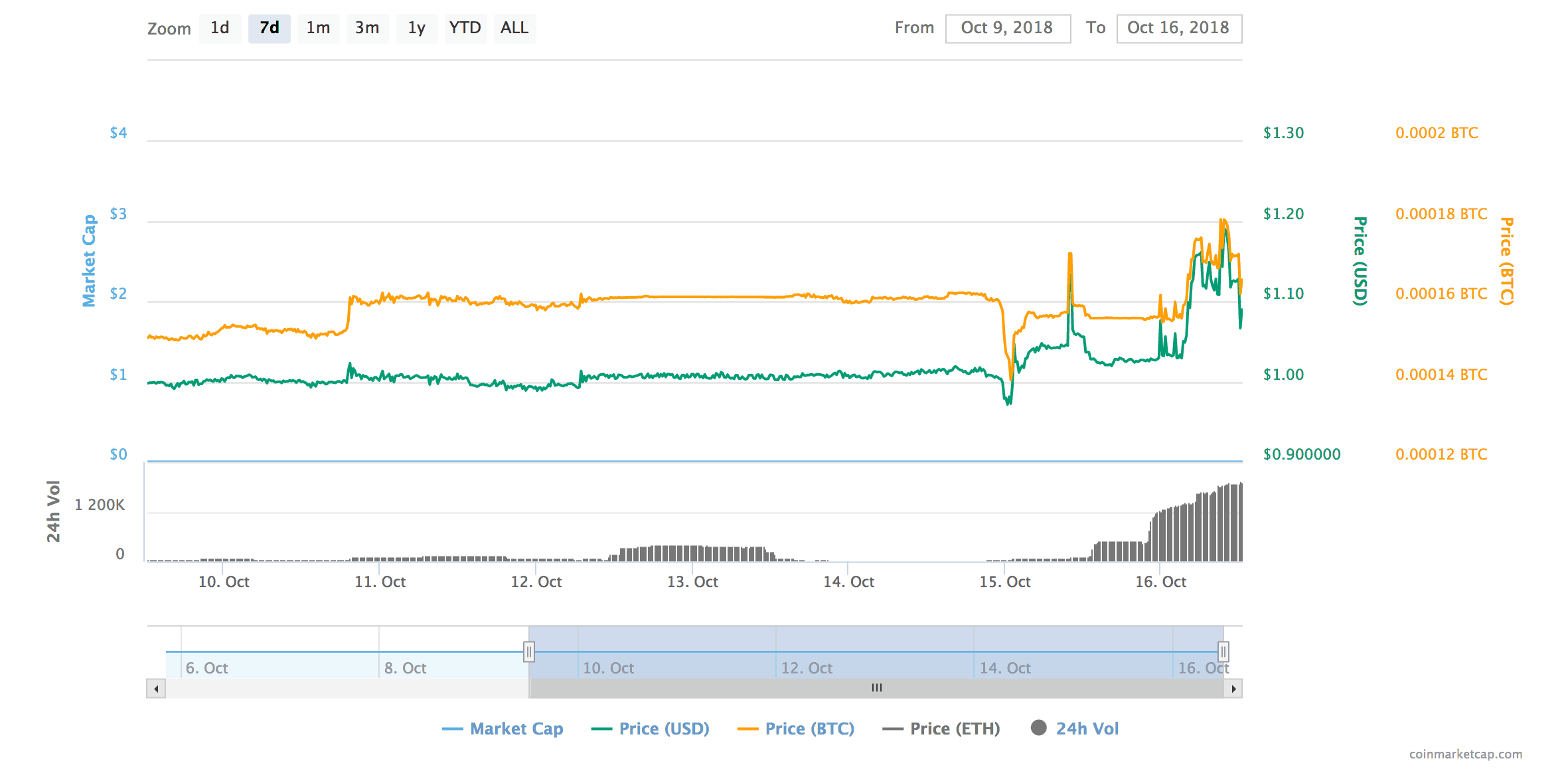

Courtesy of coinmarketcap.com

By contrast, Tether Price has been experiencing the opposite fate. At the time of writing, Tether (TUSD) costs $0.98 USD.

Today, Tether is the second most traded cryptocurrency in the market, following Bitcoin. However, Tether’s circulating supply is also dwindling. At the time of writing, Tether’s circulating supply sat at 2.26 billion USDT in comparison to 2.67 billion on October 14th, just two days earlier.

What’s In Store For Tether?

A brand new stablecoin just surpassed Tether price, reaching an all-time high as Tether hits an 18-month low. But what does this mean for the future of the more established stablecoin?

Recently, Tether has removed $300 million in tokens from the market in two strokes: one on October 9 and another on October 14. There have been no Tether tokens issued since September 21st.

Tether has since regained some of its value. However, as other cryptocurrencies like the Winklevoss’ stablecoin, 0x (ZRX) and Coinbase’s new stablecoin increase in popularity, what will happen to Tether?