What is Bitcoin? If you’re asking this, you’ve come to the right place. Our user-friendly guide breaks down everything you need to know about Bitcoin.

Bitcoin (BTC) emerged rapidly, from being unheard of one day to being of the utmost relevance and notoriety the next. New technology is often like this; by the time you’ve heard of it, you’re already miles behind. Because these developments move at a fast pace, finding up-to-date information can be difficult. That’s where we come in.

What Is Bitcoin?

The main confusion lies in the fact that Bitcoin is actually two separate things. There’s the cryptocurrency itself and then there is a peer-to-peer distributed network called blockchain that acts as a ledger for the first type.

What is Bitcoin? For starters, it was invented by a mysterious individual or group operating under the pseudonym Satoshi Nakamoto. In 2008, it sent out a notice that introduced the cryptocurrency and it’s revolutionary new peer-to-peer (P2P) system to the world. Bitcoin was officially made available for public mining in 2009. And the following year, people could convert Bitcoin to USD and trade it.

It didn’t take long for rival cryptocurrencies to emerge. Since then, the buzz around crypto has kept building.

Back to Basics: What Is Cryptocurrency?

Cryptocurrency is a digital (or virtual) currency that functions as an asset that you can trade like any other currency. What sets crypto apart is the fact that it does not have a physical form. Rather, it’s entirely digital.

When asking, “What is Bitcoin?”, it’s important to understand what sets it apart from currencies that already exist. You might wonder why we need a new currency, at all. Conversely, you might marvel at why we don’t already have a simple, international currency. This is where cryptocurrency comes in.

Cryptocurrencies are completely decentralized, meaning that they are not controlled, moderated or owned by a central power like a bank or government agency. Instead, crypto operates on a decentralized peer-to-peer network that puts control in the hands of the masses in order to generate complete transparency, accountability and trackability.

It can be difficult to wrap your mind around the decentralized model as it’s controlled by both no one and everyone at the same time. What is Bitcoin? In essence, it’s the world’s first democratic currency. Instead of the current majority-wins system, crypto is a consensus system where responsibility is held by the collective.

Understanding BTC the World’s First Crypto

Bitcoin was the first decentralized cryptocurrency the world has seen, though countless others have come into being since its inception. Another advantage that separates it from physical money is that its production is controlled, making it finite. For this reason, crypto is similar to precious metals, rather than physical money, which governments continue to print at will.

Another way to get more comfortable is to compare it to PayPal. Similar to PayPal, cryptocurrency exists in a digital wallet that lets you exchange fiat, meaning government-backed currency from a credit card, for digital money. You can hold, send, request and receive funds through your digital wallet.

The main difference is that PayPal transactions are in dollars. They’re also controlled and moderated by a third party: PayPal the company. Conversely, Bitcoin transactions occur on blockchain and only involve two parties. In this way, Bitcoin makes the third party, whether it’s a credit card or PayPal, redundant.

You Can’t Understand What Bitcoin Is Without Blockchain

As mentioned above, Bitcoin operates within blockchain. When some people reference Bitcoin, what they’re really referring to is the network or blockchain.

What is blockchain? Blockchain is a decentralized ledger system which holds a chronological record of transactions, linking each to the one prior. Originally, blockchain’s purpose was exclusively to keep a record of bitcoin transactions. Today, blockchain has many applications beyond bitcoin. For instance, other cryptocurrencies also function using blockchain technology. More broadly, you can use blockchain to store any kind of data.

Blockchain is completely decentralized, meaning that it operates on a peer-to-peer (P2P) network. This is a system in which countless computers from around the world work together to verify transactions and information.

These computers that validate blockchain transactions are called “nodes.” Nodes incentivized to work the way that they do by the chance to win crypto. In other words, they participate in Bitcoin mining, which essentially means competing to solve mathematical puzzles for funds. We’ll discuss Bitcoin mining in depth later on. You can also think of a node as the administrator of the blockchain.

The decentralized nature of the blockchain network eliminates the potential for bias, human error, tampering and false information. This is why businesses in a number of industries are interested in applying blockchain technology.

Consensus Mechanisms

There are a number of systems called “consensus mechanisms” set in place on blockchain. These work to establish a sort of objective truth among users in a democratic, inclusive way. The best-known consensus mechanisms are:

- Proof of Work (PoW)

- Proof of Stake (PoS)

- Delegated Proof of Stake (DPoS)

- Federated Byzantine Agreement (FBA)

Each of these has a specific function within blockchain.

Proof of Work and Proof of Stake are the most important blockchain elements to understand. Hypothetically, the only way to overpower blockchain is through a 51% attack to it. These two mechanisms ensure that no one gets majority control of blockchain.

Dating back to 1993, Proof of Work predates blockchain by a decade and a half. However, it acquired new significance in Satoshi Nakamoto’s Bitcoin whitepaper, the document that introduces the world to BTC. PoW validates transactions by solving those mathematical puzzles known as Bitcoin mining.

PoS systems do not use the same algorisms as PoW mechanisms. Instead, PoS works to distribute consensus by randomly and deliberately assigning people the role of block creator. In other words, one way that the creator of a block can be chosen is by how many coins they hold. For instance, if one node has 5 blocks and another has 20, the creator with 20 blocks will be chosen.

Generally, the PoS consensus mechanism takes less energy to validate. Some think of it as the ‘green version’.

What Is Bitcoin as a Network?

This leads us to Bitcoin’s second meaning: It’s also a network, or blockchain, that validates transactions by using a cryptographic protocol.

What is Bitcoin in network form? Mainly, it’s composed of different blocks, each of which represents a single transaction. Within each block is data from that transaction, a hash and the hash belonging to the previous block. A hash is the unique string of numbers and letters attached to every block. When you add a new block, it’s the node’s job to validate it.

If someone tampers with a block’s hash, it will no longer match the hash for it recorded in the following block. This is how a whole chain becomes invalid and why it’s impossible to alter or delete information once you’ve added it to the blockchain.

These transactions are kind of like Legos: They’re stackable, and you can only fit one into the other if the pegs are compatible. But unlike Legos, once you connect two blocks, you cannot separate them or change the way they’re linked.

The Network Confirms/Rejects Transactions

If you own Bitcoin, you can transfer it to another person via the network which uses blockchain technology. This network will then confirm its receipt, and permanently store important information about the transaction. For instance, it will document how, when and from whom the new owner received the cryptocurrency. If that person transfers it to someone else, the blockchain will record that transaction as well.

This is how the blockchain documents every single transaction that ever occurs in it. All cryptocurrencies share the ability to record, validate and trade anything instantaneously.

Blockchain Technology Has Other Applications

While Bitcoin only uses blockchain to buy, sell and trade that coin specifically, blockchain’s applications are infinite. At its core, blockchain is a technology that allows you to permanently and safely record transactions that you, and everyone else can access around the world instantaneously. What industry couldn’t benefit from this sort of technology?

Today, people are already using blockchain to bank, shop, crowdfund, trade stocks, store files, vote and do much more. For instance, the diamond producer De Beers just invented a way to track a diamond from mine to retail using blockchain. Audius, a blockchain-based music sharing platform, may become the Soundcloud of blockchain. Maersk, the shipping giant, just launched a blockchain platform with IBM that will save them 20 percent on shipping costs.

Though blockchain is revolutionizing the way we record transactions, it also threatens to upset the centralized authorities—think banks, governments and large corporations—that currently control our day-to-day transactions.

What Is Bitcoin Actually Worth?

Bitcoin price transcends boundaries set by governments, banks and credit card companies. No one can argue that a borderless currency is useful. But if it isn’t backed by a federal reserve, what is Bitcoin and why does it have value?

When assets do not possess intrinsic value, their worth depends on supply and demand. Remember that Bitcoin is finite. There will only ever be 21 million Bitcoin in the world.

This cap is what gives this crypto its value. But why is there a cap in the first place? This goes back to the way that we get Bitcoin: You have to build a new block that is attached to a preexisting chain.

What’s important to remember is that the rate at which you can create blocks varies. Specifically, it readjusts every 2016 blocks. This means that the number of Bitcoins you can create decreases by 50% with every 210,000 blocks, which is roughly every four years. The common consensus is that at this rate, the number of Bitcoin can never exceed 21 million.

Keep in mind that Bitcoin, and cryptocurrency as a whole, is entirely new territory. The 21 million cap is theoretical. Satoshi Nakamoto has never explained the cap.

This means that the more people invest in Bitcoin and participate in Bitcoin mining, the more applicable and less available it is. All this makes the price of Bitcoin increase.

Bitcoin Price vs. Value

Bitcoin price isn’t the same thing as its value. Like a stock, its price is in constant flux. Recently, the media has devoted a lot of attention to the rise and fall of Bitcoin price. In simple terms, if people are buying more, Bitcoin price increases. You can learn more about this through Bitcoin price analysis.

One major factor that affects the Bitcoin to USD exchange is new regulation: Prohibitory government or banking laws can affect how many people can invest in crypto, which affects short-term supply and demand. More broadly, news and search engine searches can affect its price. If its reputation suffers, so does its price.

Another element that influences Bitcoin price is the popularity of other cryptocurrencies. Today, you can convert to a number of other crypto markets, and the more exchanges there are, the more investment competition there is.

Comparatively, understanding its value requires a long-term outlook. Again, it’s useful to think of Bitcoin as a stock. While individual stocks change the price by the second, calculating a company or industry’s market value is much more complex. For instance, though the price of Tesla stock might drop, the company’s technology is still insanely valuable.

You can say the same when it comes to Bitcoin price. Since Bitcoin is limited in nature, its value can be much greater than the immediate conversion of Bitcoin to USD. A few years ago, one coin cost a few dollars but its value was much, much great, as we see reflected in its price today.

Understanding Bitcoin to USD

When asking, “What is Bitcoin?”, you should also consult a price chart. Like any other currency conversion chart, these tell you the value of Bitcoin to USD in real time. If you’re interested in charting the astronomical rise in most cryptocurrencies’ prices, you can find plenty of year and decade-long conversion charts online.

The first thing you’ll notice is that it’s the most valuable currency in the world. Today, the conversion of 1 Bitcoin to USD is around $6000. Just remember that cryptocurrency is digital, meaning that you can trade fractions of a coin. For instance, $100 USD is 0.015 Bitcoin right now.

Converting Bitcoin to USD

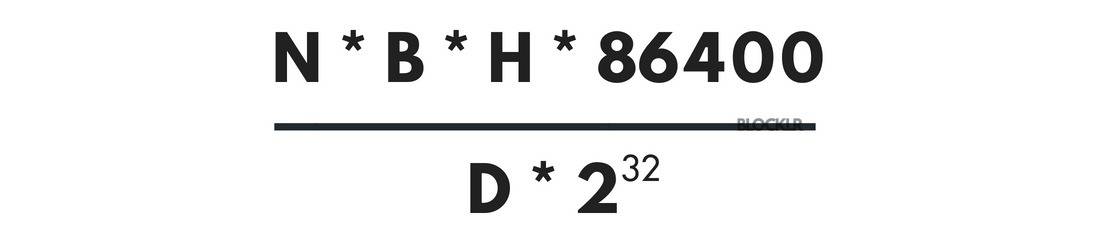

Online calculators can assist you in calculating things like mining profitability, conversion rates and expected Bitcoin earnings. To calculate your expected Bitcoin earnings, you would need to make calculations based on exchange rate fluctuations, the pool’s efficiency and stale/reject/orphan rates. To determine the conversion rate of Bitcoin to USD you would also need to use this calculation:

The letters represent:

H = Hashrate – which is hashes per second

D = Difficulty

B = Block Reward

N = Number of the days in a month

S = Seconds per day

Though this may seem simple, there’s a large margin for error. Using an online calculator is more reliable than doing it yourself.

How To Buy Bitcoin

Purchasing Bitcoin is simple. The first thing you need is a digital wallet, also known as an e-wallet. This is a virtual storage place for your crypto that you should safeguard with two-factor authentication.

It also comes with a private key, which will sign or mark every transaction that you perform. This keeps a record of who traded or stored the cryptocurrency. Though everything is anonymous when mining, each wallet will have its key ledger forever. Choose your e-wallet carefully because not all digital wallets were created equal.

How to Set Up your E-Wallet

All you need to initialize your e-wallet is a valid email address and password. Once you set it up, you will receive a Wallet ID, which is the crypto equivalent of a bank account number. In order to buy cryptocurrency, or convert Bitcoin to USD, you need a credit card, debit card or connect your e-wallet to your bank account. All these processes are relatively straightforward.

You can view all your crypto balances in the e-wallet, as well as every single transaction you’ve never initiated. And if you participate in Bitcoin mining, which we discuss later on, those funds will go directly into your e-wallet. What is crypto’s value right now? Many wallets will also chart its price in real time.

Additionally, don’t be surprised when you encounter transaction fees during the purchasing process. These fees cover the cost of mining and other costs associated with maintaining blockchain technology. Though this might feel like paying a bank fee, know that they go towards operating the blockchain system, rather than into the pockets of a centralized organization.

Bitcoin Price: What is BTC Worth Right Now?

Choosing when to convert Bitcoin to USD is not as simple as one would think. For one, an entirely different set of factors influence a cryptocurrency’s rise and fall, which makes it hard to predict the best time to invest.

However, thanks to a study conducted by Yale economists, we know that there are two main elements that influence the price of Bitcoin to USD. Momentum Effect means that if a cryptocurrency’s price starts increasing, it will likely continue to increase. The second factor is investor attention. In short, the more positive news and online discussion about it, the more the conversion rate of Bitcoin to USD shifts in the cryptocurrency’s favor.

But note that these factors that drive the price of cryptocurrency up can also make it plummet. The most negative news you encounter about this cryptocurrency, the more you can expect the relationship of Bitcoin to USD to equalize.

No matter when or how much you choose to invest in cryptocurrency, remember to do your due diligence. This also means staying up to date on scams and price manipulation.

Mine It Yourself: What Is Bitcoin Mining?

Intimidated by the conversion of Bitcoin to USD? You can also mine your own.

The process, carried out by nodes, of validating blockchain transactions in order to win cryptocurrency is called Bitcoin mining. Bitcoin mining is when you solve a math puzzle within the network. The speed and accuracy with which you solve the puzzle determine how much you earn. Anyone can mine, but you first need to buy Bitcoin mining hardware and software.

What Is a Miner?

Without the proper hardware, Bitcoin mining can consume so much power that the cost of mining outweighs your earnings. You can also buy cloud Bitcoin mining services, which are simpler but less secure.

With the proper equipment, there are the simplified steps you will need to follow.

Steps to Verifying a Transaction

- A transaction is sent to every node.

- A Bitcoin mining node will collect these transactions creating a block.

- The mining node will be working to find a proof-of-work code and adding it to its block.

- After a node has added to a block, it will then send the block to all nodes for validation.

- The nodes receive the block to validate its transactions. It will only accept this block if the previous transactions are all correct.

- You’ll know that a node has accepted a transaction because it will move onto another block and incorporate the hash. The use of two hashes is why we call Bitcoin mining a “double hash verification process.”

You can also join a Bitcoin mining pool. These groups work together to solve the equations and split the earnings. Joining a Bitcoin mining pool significantly increases your chance of earning currency as a miner. Of course, you’ll need an active e-wallet to receive your earnings and convert your Bitcoin to USD.

Bitcoin mining can be risky and you may not earn back your initial investment. Additionally, there are a lot of illegal crypto mining operations out there. Before beginning, carefully factor in the energy, time and money it will cost to set yourself up for Bitcoin mining.

But what happens to Bitcoin price after we minded all of the BTC? There can never be more than 21 million, which gives it value.

Keeping Up with Bitcoin News

Bitcoin is still in its infancy—which is why it’s so fascinating. What is Bitcoin and what is its true value? Though crypto is booming, it’s almost impossible to grasp the full impact that a safe, convenient and borderless currency will have on the world.

What we do know is that crypto is here to stay. Not only does it let you pay for things more cheaply, but it forces us to reevaluate much of the bureaucracy within society. Banks, credit card companies country borders—man-made limitations are trivial in the face of cryptocurrency’s international interconnectedness.

What is Bitcoin? It’s the future that’s already here. Cryptocurrency and blockchain technology is projected to be worth $700 billion within the next few years.