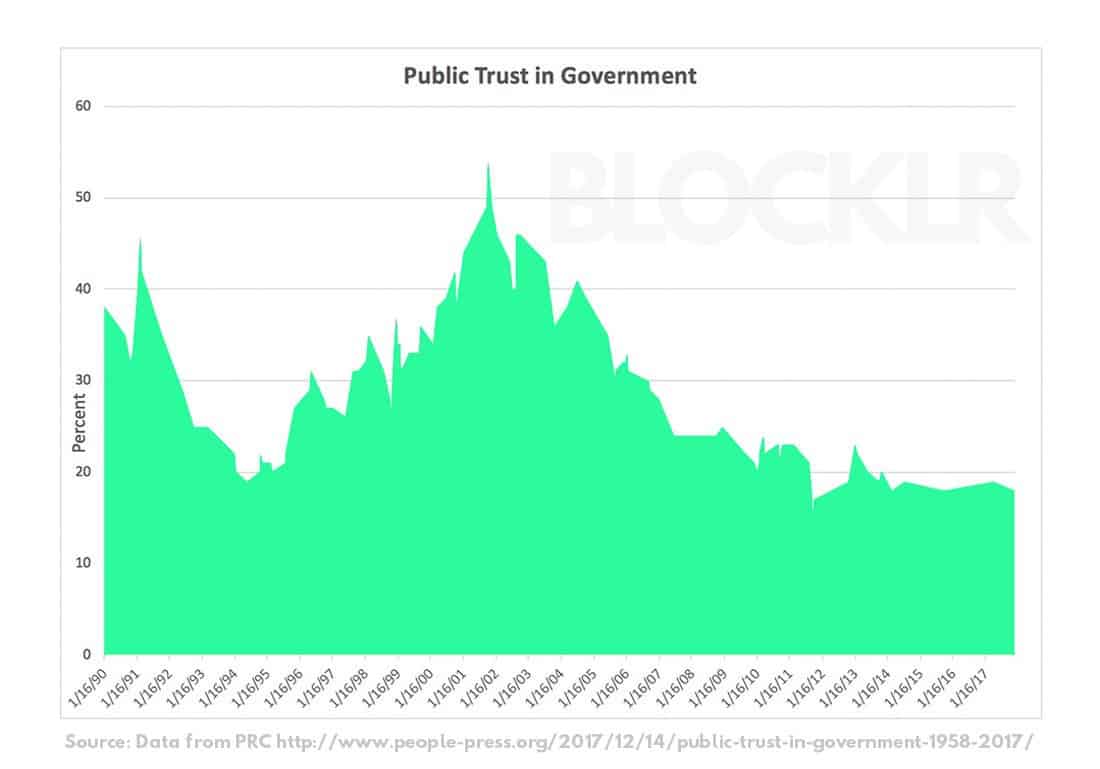

To understand Bitcoin, think back to when and why it was invented. The 2008 Financial Crash led to the biggest economic downturn in U.S. history since the Great Depression. As a result, confidence in banks and governments reached an all-time low. This drastic shift in public opinion inspired three era-defying movements. The first two, the Tea Party and Occupy Wall Street, have left their mark on American politics. But the third and most important movement was Bitcoin.

What Happened in 2008

According to the U.S. Department of Labor, 8.8 million people lost their jobs after the 2008 Financial Crash. This was the most significant and widest-ranging economic downturn since the 1930s. The Great Recession shocked the world.

The general consensus is that subprime lending led to the financial crisis in 2008. This is when banks loan people money they cannot afford to pay back. Taking financial risks amplified short-term economic growth, but ultimately led to the collapse of the banking system and government bailouts.

In addition to causing financial hardship for millions of Americans, the Great Recession also brought about rampant distrust of institutions, ranging from banks to the government. A decade later, the backlash to the financial crisis has lessened. However, the political, social, and financial upheaval it inspired has permanently changed the American landscape.

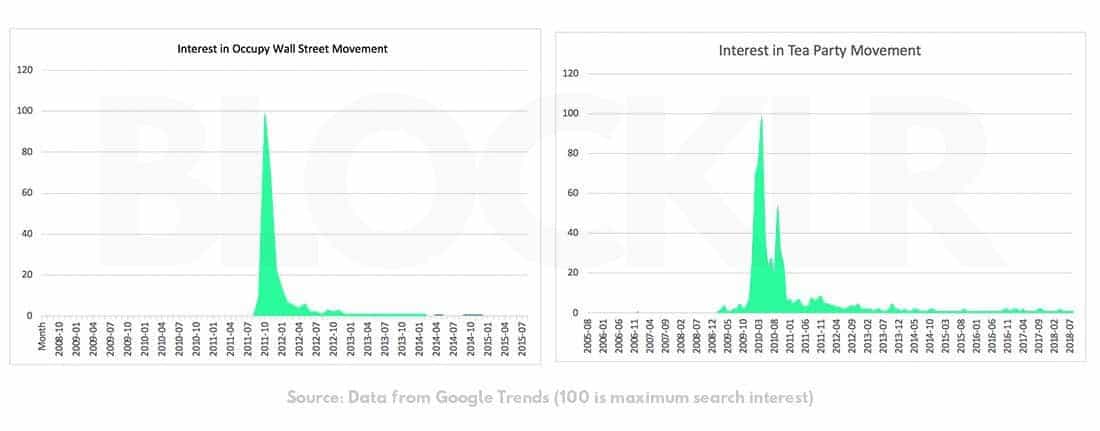

The Financial Crash Gave Us Two Political Movements

Two political movements, one liberal and the other conservative, came out of the financial crisis. The Tea Party, a form of populist and conservative Republicanism, was born in 2009. First, they protested the relief packages sponsored by Presidents George Bush and, later, Barack Obama. In 2010, Tea Party candidates won a record-breaking 60 seats in the House of Representatives.

Today, the original Tea Party has given way to the Republican establishment. In other words, an establishment Republican in 2018 is almost interchangeable with a controversial Tea Party candidate from a few years ago. More significantly, many speculate that Donald Trump became president due to the wave of popularism ushered in by the Tea Party in 2009.

The second political movement that came out of the 2008 Financial Crash was Occupy Wall Street. In 2011, protesters gathered in New York’s financial district to challenge wealth inequality and political corruption. Though their political influence is arguably less long-lasting, the concepts introduced during the Occupy Wall Street movement still pervade political-economic discourse today. For instance, the 99%, meaning those exempt from the top 1% of wealthiest Americans, was originally an Occupy Wall Street Slogan.

Bitcoin Came Out of the 2008 Financial Crash

One month after the 2008 Financial Crash, an anonymous individual or group under the name Satoshi Nakamoto introduced the world to Bitcoin. Bitcoin arose from the same dissatisfaction with the status quo as both liberal and conservative political movements. Yet unlike these campaigns, which had little effect on the role big business pays in politics, Bitcoin continues to threaten the supremacy of the financial institutions that caused the 2008 recession.

It is no coincidence that the first modern-day currency that cannot have a central authority came about one month after a financial crash that the world blamed on big banks that operated through corrupt government channels. Therefore, Bitcoin exists in opposition to institutions by design. Operating on a decentralized ledger system, it cannot have a central authority like the Federal Reserve, credit card companies or big banks. And supply and demand, rather than government controlled inflation, regulate Bitcoin.

The act of creating Bitcoin was, in and of itself, a rebellion against the institutions of our time.

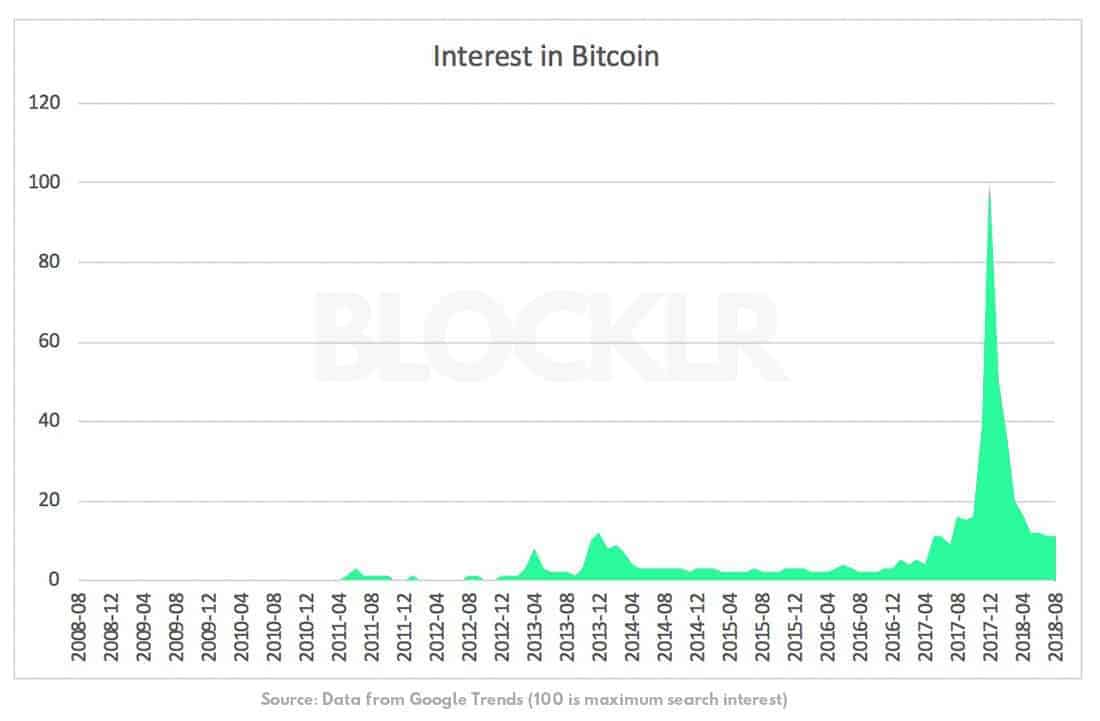

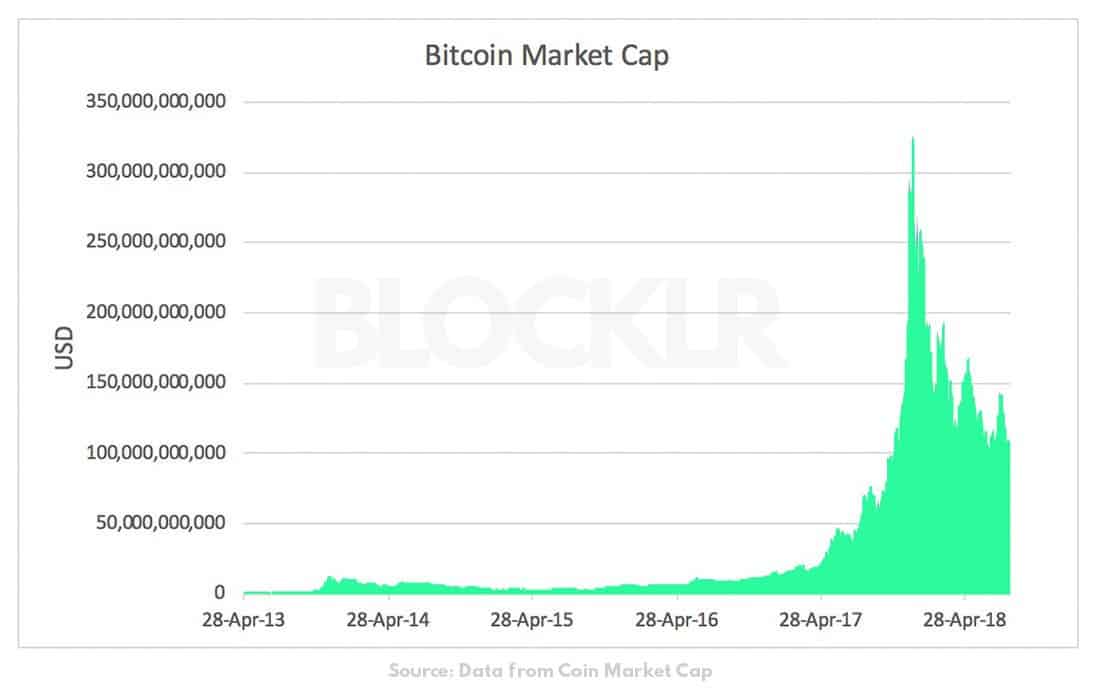

Bitcoin’s Influence Continues to Grow

Today, the 2008 financial crash and the fear of institutions it inspired is a distant memory. Occupy Wall Street has given way to the complacency that comes with renewed financial security. The Tea Party has since come to resemble the GOP it once criticized—and acquired the same level of corporate backing. The fact that these movements were decentralized, meaning that they had never had a clear leader or mission, was their undoing.

But Bitcoin has only become a more powerful version of itself. The cryptocurrency that was worth pennies in 2008 is now the most valuable currency, worth $6,436 USD per coin. With the advent of safe cryptocurrency wallets and wider adoption, it has never been easier to buy, loan, or store Bitcoin—all while depriving credit card companies and banks of their processing fees. Furthermore, cryptocurrency continues to highlight how artificial government-backed currencies and, by extension, international borders and governments, truly are.

Additionally, the blockchain technology invented along with Bitcoin has more applications than ever. One of the biggest potential applications for blockchain is voting, which they’re already testing in South Korea. Because blockchain doesn’t exist in one place, it’s almost impossible to hack. Mobile applications like Voatz are already testing blockchain for voting in town meetings. Following an Estonia-based trial, Nasdaq announced that blockchain voting platforms were secure enough to allow shareholders to use them to cast votes.

Do Blockchain Challenge Big Corporations?

As the last example illustrates, blockchain has huge appeal for large companies, especially those that caused the financial crisis. Bank of America paid $76 billion in fines because of the role they played in the financial crisis, according to Market Watch. Today, Bank of America holds the most blockchain patents in the US.

Goldman Sachs, which betted that people would default on their mortgages, is also getting into blockchain with crypto securities. Fidelity Investments is another massive financial services company heavily invested in blockchain intellectual property.

An increase in big business blockchain applications, ranging from shipping to diamonds, begs the question: Does this technology still oppose big corporations, or have Fortune 500 companies subsumed blockchain technology?

Bitcoin: Legacy of the 2008 Financial Crash

Blockchain has led to the creation of leaner, innovative lending companies than the financial giants that lead to the crash. Conversely, big corporations are working hard to control and apply the technology behind it.

But Bitcoin and blockchain are not the same thing. Bitcoin, and other cryptocurrencies like it, have made it easier than ever to spend money outside of banks and credit cards.

Though the Tea Party’s influence can decrease with the election cycle, Bitcoin has taken on a life of its own beyond political context. Though the world first understood Bitcoin as a rebellion against the status quo, Bitcoin is now a full-fledged, operational currency. It was never just a movement that can wax and wane.

This isn’t to say that Bitcoin’s symbolism won’t return to importance. When the next economic downturn comes, everyone will remember why we needed Bitcoin in the first place.